The global needles market is projected to expand significantly, with an expected size of USD 16.6 billion by 2033, up from USD 8.2 billion in 2023, reflecting a CAGR of 7.3% from 2024 to 2033. This growth is driven by several key factors. The rising prevalence of chronic diseases such as diabetes and cancer increases the demand for needles, particularly for self-administration and safety needles. The development and distribution of COVID-19 vaccines have also significantly boosted needle demand, necessitating increased production and supply capacity.

However, the market faces challenges including stringent regulatory requirements and the high cost of advanced needle technologies. Additionally, the risk of needlestick injuries remains a concern, necessitating the adoption of safety needles to mitigate these risks.

Recent developments in the market include the introduction of advanced needle technologies and increased strategic collaborations among key players. For instance, companies are focusing on developing needles compatible with high-power injectable technologies and enhancing the safety features of needles to reduce the risk of infections.

North America and Europe currently dominate the market, supported by robust healthcare infrastructure and significant government initiatives. Meanwhile, the Asia-Pacific region is expected to witness the fastest growth, driven by increasing healthcare expenditures and a rising awareness of the importance of safe injection practices.

Key Takeaways

- The market size is projected to reach USD 16.6 billion by 2033, growing at a 7.3% CAGR from USD 8.2 billion in 2023.

- Advances in needle technology aim to reduce anxiety, with safety needles expected to grow rapidly due to their operational and infection resistance benefits.

- Pen needles hold over 62.3% of the market share in 2023, driven by the increasing diabetic patient population worldwide.

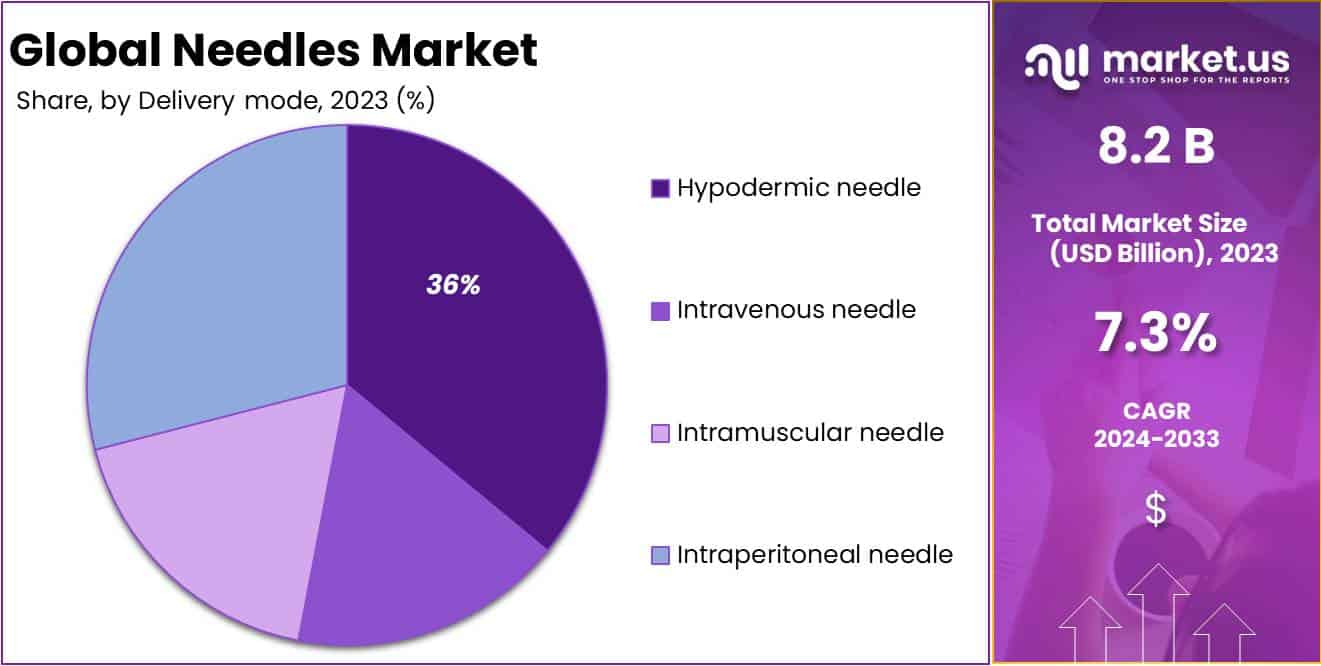

- Hypodermic needles dominate delivery modes with a 36% market share in 2023, while intravenous needles are anticipated to grow rapidly.

- Stainless steel needles lead with a 42.3% market share in 2023, favored for their durability and reusability.

- Hospitals hold a 63.4% market share in 2023, aligning with WHO guidelines for safer needle use practices.

- The safety needle segment is anticipated to be the fastest-growing during the forecast period, offering simplicity and reduced infection risk.

- North America dominates, contributing over 43.9% revenue share and holding a USD 3.9 billion market value in 2023.

- The growing preference for self-administration of medications enhances demand for self-injectable solutions, easing needle-related anxiety.

Get Sample PDF Report: https://market.us/report/needles-market/request-sample/

Needles Market Key Segments

Based on Type

- Conventional Needles

- Safety Needles

Based on Product Type

- Suture Needles

- Blood Collection Needles

- Ophthalmic Needles

- Dental Needles

- Insufflation Needles

- Pen Needles

Based on the Delivery Mode

- Hypodermic Needles

- Intravenous Needles

- Intramuscular Needles

- Intraperitoneal Needles

Based on Material

- Glass Needles

- Plastic Needles

- Stainless Steel Needles

- Polyether Ether Ketone Needles

Based on End Users

- Hospitals

- Diagnostic Centers

Key Regions

- North America (The US, Canada, Mexico)

- Western Europe (Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe)

- Eastern Europe (Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe)

- APAC (China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC)

- Latin America (Brazil, Colombia, Chile, Argentina, Costa Rica, Rest of Latin America)

- Middle East & Africa (Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA)

Buy Directly: https://market.us/purchase-report/?report_id=96056

Key Players Analysis

Becton, Dickinson and Company (BD) is a prominent player in the needles market, specializing in a range of medical devices, including needles for various applications. BD’s products are widely used in hospitals and clinics for drug delivery, blood collection, and vaccinations. The company’s innovative safety needles reduce the risk of needlestick injuries, contributing to improved healthcare worker safety. BD’s significant contracts for COVID-19 vaccination programs have reinforced its market position, reflecting robust demand and extensive distribution networks.

Johnson & Johnson, through its subsidiary Ethicon, is a major competitor in the needles sector, focusing on surgical needles and suture technologies. Ethicon’s needles are integral to wound closure procedures, enhancing surgical outcomes. The company emphasizes innovation in needle design, aiming to improve patient comfort and procedural efficiency. Johnson & Johnson’s extensive portfolio in medical devices and pharmaceuticals positions it strongly in the healthcare market, driving growth in the needles segment.

Stryker Corporation offers a diverse range of medical devices, including needles for various surgical and diagnostic purposes. Stryker’s hypodermic and suture needles are designed for precision and reliability, essential for surgical interventions. The company’s focus on enhancing surgical technologies aligns with the increasing demand for advanced medical procedures. Stryker’s commitment to innovation and quality in needle manufacturing supports its strong market presence and continued growth.

Medtronic PLC is a key player in the needles market, providing products for diabetes management and other medical applications. Medtronic’s pen needles, used for insulin administration, are vital for diabetic patients worldwide. The company’s emphasis on developing user-friendly and efficient needle designs enhances patient adherence and treatment outcomes. Medtronic’s strategic initiatives in product development and market expansion contribute to its leadership in the global needles market.

Ethicon Inc., a subsidiary of Johnson & Johnson, specializes in surgical sutures and needles. Ethicon’s products are essential for various surgical procedures, ensuring effective wound closure and patient recovery. The company’s advanced needle technologies and focus on surgical innovations make it a leader in the surgical needles market. Ethicon’s strong market presence and commitment to quality support its continued growth and influence in the healthcare industry.

Needles Market Key Players:

- Dickinson and Company

- Johnson & Johnson

- Stryker Corp.

- Medtronic PLC

- Ethicon Inc.

- Novo Nordisk A/S

- Boston Scientific Corporation

- Smith’s Medical Inc.

- Hilgenberg GmbH

- Other Key players

Needles Market Report Scope >> Market Value (2023): USD 8.2 Billion || Forecast Revenue (2033): USD 16.6 Billion || CAGR (2024-2033): 7.3% || Base Year Estimation: 2023 || Historic Period: 2019-2022 || Forecast Period: 2024-2033.

Inquire More about report: https://market.us/report/needles-market/#inquiry

About Market.US

Market.US is renowned for its comprehensive market research and analysis, providing customized and syndicated reports to a global clientele. Specializing in a variety of sectors, they offer strategic insights and detailed market forecasts, assisting businesses in making informed decisions. With a focus on innovation and accuracy, Market.US supports clients in over 126 countries, and maintains a strong repeat customer rate, underscoring their commitment to quality and client satisfaction. Their team excels in delivering exceptional research services, ensuring that no detail is overlooked in any target market.

Contact Details

Market.us (Powered By Prudour Pvt. Ltd.)

Contact No: +1 718 618 4351.

Email: [email protected]

Blog: https://medicalmarketreport.com/

View More Trending Reports

Sterilization Equipment Market Will Grow Nearly USD 32.4 Billion At A Rate Of 9.4% By 2032

Ophthalmic Devices Market Will Reach USD 76 Billion By 2033 And Hit Around 4.8% CAGR

eClinical Solutions Market Outlook: Expected To Expand To USD 27 Billion Upholding A 12.8% CAGR