The latest research report provides a complete assessment of the Credit Insurance market for the forecast year 2023-2033, which is beneficial for companies regardless of their size and revenue. This survey report covers the major market insights and industry approach towards upcoming years. The Credit Insurance market report presents data and information on the development of the investment structure, technological improvements, market trends and developments, capabilities, and comprehensive information on the key players of the Credit Insurance market. The worldwide market strategies undertaken, with respect to the current and future scenario of the industry, have also been listed in the study.

The worldwide market for Credit Insurance Market is expected to grow at a CAGR of roughly 3.6% over the next ten years, and will reach US$ 11,197.7 Mn in 2028, from US$ 7,863.8 Mn in 2018, according to a new Market.us (Prudour Research) study.

The study brings a perfect bridging between qualitative and statistical data of Credit Insurance Market. The study provides historical data (i.e. Consumption & Value) from 2017 to 2022 and forecasts till 2033. The market report additionally has information concerning the supply-demand, market growth and improvement factors, business earnings and loss, economic grade, and certain strategic tips mentioned. The numerical statistics are copied with statistical tools, collectively with SWOT assessment, BCG matrix, and PESTLE assessment. Statistics are provided in graphical form to provide easy expertise of the facts and figures.

Charts and data tables about market and segment sizes for a historic period of five (2017-2022) years have been covered in this report | View our PDF FREE Sample Report @ https://market.us/report/credit-insurance-market/request-sample/

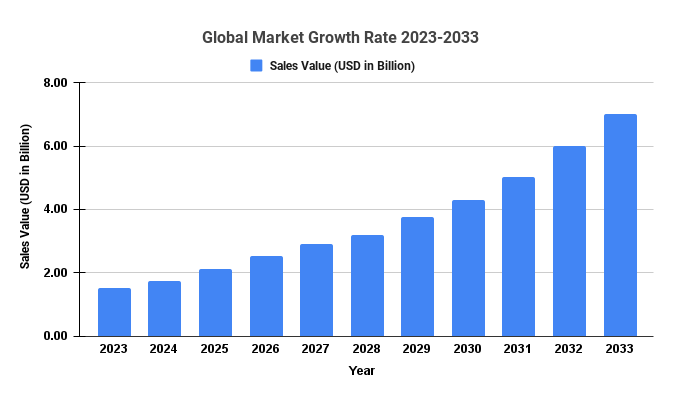

Figure:

Why is Our research important?

There are several reasons why it is important. A few of the key reasons include it:

– A company can determine if a product or service, new or existing, is feasible

– Provides assistance to companies in identifying and developing new segments of the market

– Allows companies to gauge the demand for new services, products or features before actually launching them

– Boosts the overall success of marketing, advertising and promotional campaigns

– Evaluates market trends in order to help companies develop strategies to adapt to them

– Companies can use this tool to determine the best product placement for their products.

Competitive Spectrum – Top Companies leveraging Credit Insurance Market

Euler Hermes

Atradius

Coface

Zurich

Credendo Group

QBE Insurance

Cesce

**Note: If any Company(ies) of your interest has/have not been disclosed in the above list then please let us know the same so that we will check the data available in our database and provide you the confirmation or inclusion in the final deliverables.**

Not interested in buying the full report? No problem. You can buy individual sections instead. Would you like to see the price list for each section? Get the details here: https://market.us/report/credit-insurance-market/#inquiry

With competitive analysis research, you can find out things like:

1. Who your competitors are?

2. What they’ve done in the past?

3. What’s working well for them?

4. How they’re positioned in the market?

5. How do they market themselves?

6. What they’re doing that you’re not?

7. Their weaknesses

Credit Insurance Market Segments Evaluated in the Report:

Product Overview

.I

.II

Classified Applications of Credit Insurance Market

Domestic Trade

Export Trade

Key regions divided during this report:

– The Middle East and Africa Credit Insurance Market (Saudi Arabia, United Arab Emirates, Egypt, Nigeria, South Africa)

– North America Credit Insurance Market (United States, Canada, Mexico)

– Asia Pacific Credit Insurance Market (China, Japan, Korea, India, Southeast Asia)

– South America Credit Insurance Market (Brazil, Argentina, Colombia)

– Europe Credit Insurance Market (Germany, UK, France, Russia, Italy)

Access the full study findings here: https://market.us/report/credit-insurance-market/

Why buy?

– Data-Driven Decision Making and Business Opportunities

– Identify growth strategies across markets

– Analyze your competitor’s market

– Know the financial performance of competitors with better insight

– Benchmark performance in comparison to key competitors

– Develop regional and country strategies

Credit Insurance market research report will be sympathetic for:

1. New Investors

2. Propose investors and private equity companies

3. Cautious business organizers and analysts

4. Intelligent network security Suppliers, Manufacturers and Distributors

5. Government and research organizations

6. Speculation / Business Research League

7. End-use industries And much more

FAQs or How Report will help you?

Q1. How big is the Credit Insurance market?

Q2. What is the projected market size & growth rate of the Credit Insurance Market?

Q3. What are the key driving factors for the growth of the Credit Insurance Market?

Q4. What are the key trends in the Credit Insurance market report?

Q5. What is the total market value of Credit Insurance market report?

Q6. What segments are covered in the Credit Insurance Market Report?

Q7. Who are the key players in Credit Insurance market?

Q8. Which region has the highest growth in Credit Insurance Market?

Report Scope

| Report Attribute | Details |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2033 |

TOC Highlights:

Chapter 1. Introduction

The Credit Insurance research work report covers a brief introduction to the global market. this segment provides opinions of key participants, an audit of Credit Insurance industry, an outlook across key regions, financial services and various challenges faced by Credit Insurance Market. This section depends on the scope of the study and report guidance.

Chapter 2. Outstanding Report Scope

This is the second most important chapter, which covers market segmentation along with a definition of Credit Insurance. It defines the entire scope of the Credit Insurance report and the various facets it is describing.

Chapter 3. Market Dynamics and Key Indicators

This chapter includes key dynamics focusing on drivers[ Includes Globally Growing Credit Insurance Prevalence and Increasing Investments in Credit Insurance, Key Market Restraints [High Cost of Credit Insurance], opportunities [Emerging Markets in Developing Countries] and also presented in detail the emerging trends [Consistent Launch of New Screening Products] growth challenges, and influence factors shared in this latest report.

Chapter 4. Type Segments

This Credit Insurance market report shows the market growth for various types of products marketed by the most comprehensive companies.

Chapter 5. Application Segments

The examiners who wrote the report have fully estimated the market potential of key applications and recognized future opportunities.

Chapter 6. Geographic Analysis

Each regional market is carefully scrutinized to understand its current and future growth, development, and demand scenarios for this market.

6.1 North America: insight study

6.2 Europe: serves complete insight study

6.3 Asia-Pacific

6.4 Rest of the World

Chapter 7. Top Manufacturing Profiles

The major players in the Credit Insurance market are detailed in the report based on their market size, market service, products, applications, regional growth, and other factors.

Chapter 8. Pricing Analysis

This chapter provides price point analysis by region and other forecasts.

Chapter 09. North America Credit Insurance Market Analysis

This chapter includes an assessment of Credit Insurance product sales across major countries of the United States and Canada along with a detailed segmental outlook across these countries for the forecasted period 2022-2031.

Chapter 10. Latin America Credit Insurance Market Analysis

Major countries of Brazil, Chile, Peru, Argentina, and Mexico are assessed apropos to the adoption of Credit Insurance.

Chapter 11. Europe Credit Insurance Market Analysis

Market Analysis of Credit Insurance report includes insights on supply-demand and sales revenue of Credit Insurance across Germany, France, United Kingdom, Spain, BENELUX, Nordic and Italy.

Chapter 12. Asia Pacific Excluding Japan (APEJ) Credit Insurance Market Analysis

Countries of Greater China, ASEAN, India, and Australia & New Zealand are assessed and sales assessment of Credit Insurance in these countries is covered.

Chapter 13. The Middle East and Africa (MEA) Credit Insurance Market Analysis

This chapter focuses on Credit Insurance market scenario across GCC countries, Israel, South Africa, and Turkey.

Chapter 14. Research Methodology

The research methodology chapter includes the following main facts,

14.1 Coverage

14.2 Secondary Research

14.3 Primary Research

Chapter 15. Conclusion

Trending Reports] + Covid-19 scenario+ Impact of Russia-Ukraine war):

LED Display Market Research Revenue | Valuation To Surge At Healthy CAGR Through 2031

Enteral Feeding Tube Market 2022 Size, Business Growth, Demand, and Forecast to 2031

Bumper Stickers market Growth CAGR of 6.06%, Restraints, Mergers And Forecast (2022-2031)

Global Bedroom Furniture Market 2023: Why Now Is A Great Time To Buy One?

The Growing Brake Friction Market: What You Need to Know

Remote Control Systems and Kits Market Is Anticipated To Register Around 6.6% CAGR From 2021-2028

Communication Contact:

Global Business Development Team: market.us

market.us (Powered By Prudour Pvt. Ltd.)

Send Email: [email protected]

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351

Website:https://market.us