Banking Process Automation (BPA) refers to using technology to automate repetitive, time-consuming banking tasks – such as processing loan applications, managing customer accounts or handling customer inquiries – within an institution’s environment. BPA helps banks improve efficiency while cutting costs and offering improved customer service.

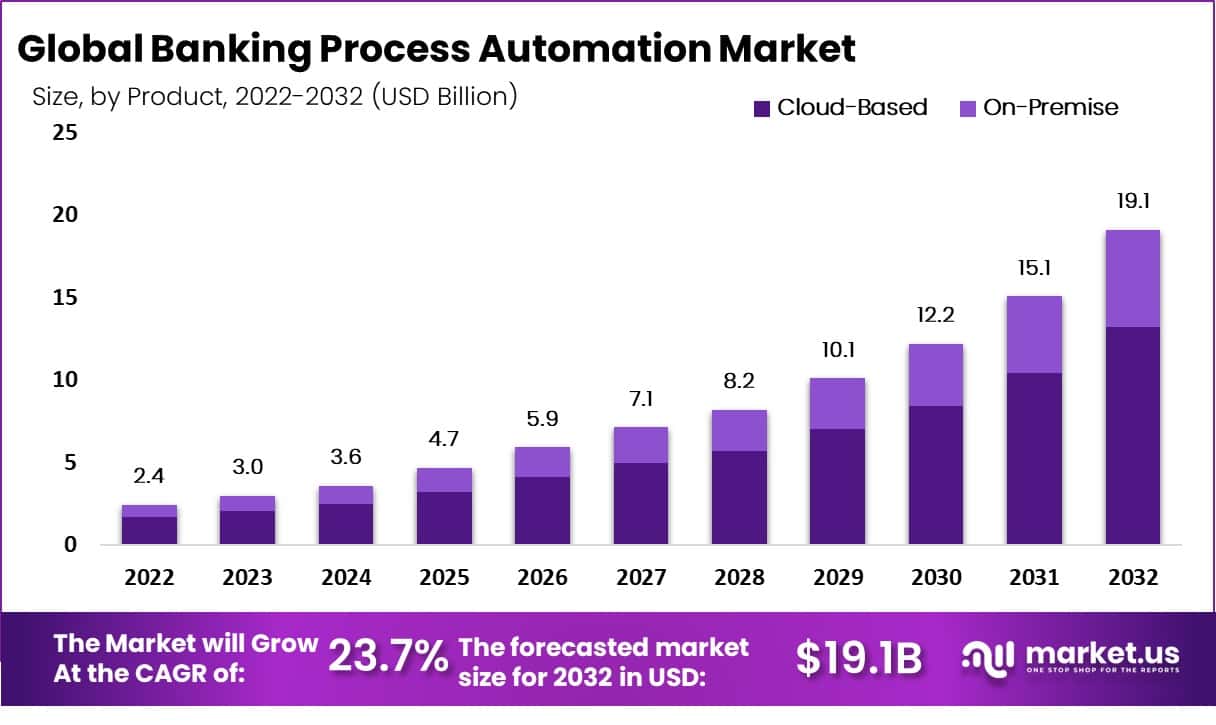

According to Market.us, The Global Banking Process Automation Market is anticipated to achieve a value of roughly USD 19.1 Billion by 2032, a substantial rise from its 2022 value of USD 2.4 Billion, at a compound annual growth rate (CAGR) of 23.7% during the forecast period from 2023 to 2032. The growth of the market is being driven by the increasing adoption of automation technologies in the banking industry, the need to improve efficiency and reduce costs, and the growing demand for customer-centric services.

Don’t miss out on business opportunities | Get sample pages at https://market.us/report/banking-process-automation-market/request-sample/

Below are a few key trends within the banking process automation market:

- Rising adoption of robotic process automation (RPA) technology is one of the major trends in financial services today. RPA allows banks to automate repetitive and rule-based tasks more efficiently while cutting costs at the same time. This trend could help increase efficiency while decreasing expenses.

- Cognitive automation has also emerged as a prominent trend. Cognitive automation uses artificial intelligence and machine learning technology to automate tasks that traditionally required human judgment; using this strategy banks can improve customer service delivery while mitigating risks.

- Intelligent process automation (IPA), an emerging trend in the market, has also proven itself. Intelligent process automation encompasses robotic process automation (RPA), cognitive automation and other forms of technology used to automate complex tasks more efficiently – helping banks attain new heights of automation and efficiency.

- Cloud-based banking process automation solutions have quickly become one of the fastest-growing trends on the market. They offer various advantages including scalability, flexibility and cost-effectiveness that cannot be found elsewhere.

Buy this Complete Business Report@ https://market.us/purchase-report/?report_id=106046

Rising Demands

The banking process automation market is seeing rising demands from banks for a number of reasons. These reasons include:

- The need to improve efficiency and reduce costs.

- The need to improve customer service.

- The need to comply with regulations.

- The need to stay ahead of the competition.

Increasing Uses

The banking process automation market is seeing increasing uses for a number of reasons. These reasons include:

- The increasing complexity of banking operations.

- The increasing volume of data that banks need to process.

- The growing demand for real-time processing.

- The need to improve security and compliance.

Rising Popularity

The global banking process automation market is seeing rising popularity due to a number of factors. These factors include:

- The proven benefits of automation.

- The increasing availability of automation technologies.

- The declining cost of automation technologies.

- The growing demand for automation from banks.

Market Segments

Deployment Mode

- Cloud-Based

- On-Premise

Application

- Customer Service and Support

- Risk Management and Compliance

- Payment Processing

- Account Management

- Other Applications

Organization Size

- Large Enterprises

- SMEs

Top Key Players in Banking Process Automation Market

- IBM Corporation

- UiPath

- Automation Anywhere

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Blue Prism

- Pegasystems Inc.

- Kofax Inc.

- NICE Systems

- Other Key Players

Explore More Reports

Low-latency Content Sharing Market