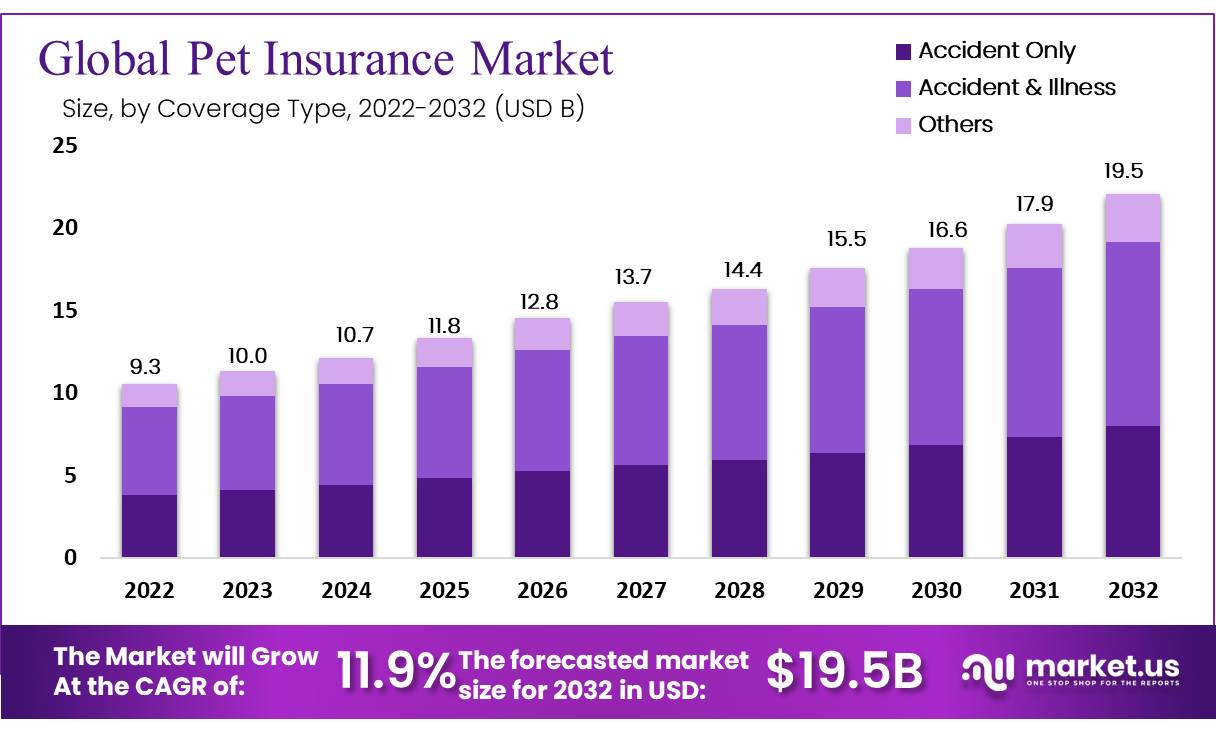

The global pet insurance market is experiencing significant growth, with its market size expected to increase from USD 9.3 billion in 2022 to approximately USD 19.15 billion by 2032, at a compound annual growth rate (CAGR) of 11.9%. This expansion can be attributed to several key factors. Firstly, the rise in pet adoption, particularly post-pandemic, has driven the demand for pet insurance as pet owners increasingly view pets as family members, necessitating comprehensive healthcare coverage. Secondly, the rising cost of veterinary services has made pet insurance a more attractive option for pet owners to manage expenses associated with their pets’ health.

However, the market also faces challenges. A significant obstacle is the lack of standardized pet health codes for insurance reimbursement, which complicates claims processing and can deter potential customers. Additionally, there is relatively low awareness about pet insurance in emerging markets, limiting the market’s growth potential in these regions.

Recent developments in the industry include strategic partnerships and acquisitions aimed at expanding market reach and product offerings. For instance, Chewy Inc. partnered with Trupanion Inc. to provide a range of pet health insurance and wellness plans, enhancing accessibility for over 20 million Chewy customers. This trend of collaboration between e-commerce platforms and insurance providers is expected to continue, driving further growth in the market.

Overall, the pet insurance market is poised for substantial growth due to increasing pet ownership, rising veterinary costs, and innovative insurance solutions, despite facing challenges related to standardization and market awareness.

Key Takeaways

- The pet insurance market is projected to reach USD 27.8 billion by 2032.

- The market is expected to grow at a CAGR of 11.9% from 2023 to 2032.

- The accident & illness pet insurance segment dominated the market in 2022.

- The cat segment is anticipated to dominate the market by animal type during the forecast period.

- The direct sale channel sub-segment dominated the market in 2022 by sales channel.

- Europe held the dominant market share in 2022, accounting for 30% of the market.

- North America is expected to have the second-largest revenue in the forecast period.

- Asia Pacific is projected to have the highest CAGR during the forecast period.

Get Sample PDF Report: https://market.us/report/pet-insurance-market/request-sample/

Pet Insurance Market Key Segments

Based on Coverage Type

- Accident Only

- Accident & Illness

- Others

Based on Animal Type

- Dogs

- Cats

- Others

Based on Sales Channel

- Broker

- Direct

- Agency

- Bancassurance

Based on Provider

- Public

- Private

Key Regions

- North America (The US, Canada, Mexico)

- Western Europe (Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe)

- Eastern Europe (Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe)

- APAC (China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC)

- Latin America (Brazil, Colombia, Chile, Argentina, Costa Rica, Rest of Latin America)

- Middle East & Africa (Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA)

Buy Directly: https://market.us/purchase-report/?report_id=32245

Key Players Analysis

Trupanion, a leading provider of medical insurance for cats and dogs, is recognized for its comprehensive coverage and innovative approach. The company offers a subscription-based model and focuses on providing unlimited payouts without annual caps. Trupanion’s extensive network includes partnerships with veterinary clinics, enhancing accessibility for pet owners. Recent initiatives, such as truInsights, aim to provide valuable pet health data and insights to customers. With a strong market presence in North America, Europe, and Australia, Trupanion continues to expand its offerings and improve customer service through technological advancements and strategic collaborations.

Nationwide Mutual Insurance Company, a significant player in the pet insurance market, offers comprehensive plans covering accidents, illnesses, and wellness. Known for its wide range of coverage options, Nationwide caters to various pet needs, including exotic pets. The company has a robust online presence, making it easy for customers to access policy information and manage claims. As a well-established insurer, Nationwide leverages its extensive resources and expertise to provide reliable and flexible pet insurance solutions, contributing to the growing adoption of pet insurance across the United States.

Healthy Paws Pet Insurance LLC specializes in providing extensive coverage for accidents and illnesses without any annual or lifetime caps on payouts. The company emphasizes fast claim processing and offers a user-friendly mobile app for managing policies and claims. Healthy Paws is known for its dedication to customer satisfaction and transparency in policy terms. By focusing on high-quality service and comprehensive coverage, Healthy Paws has established a strong reputation in the pet insurance market, contributing to the overall growth and awareness of pet health insurance.

Embrace Pet Insurance Agency LLC offers customizable pet insurance policies, allowing pet owners to tailor coverage based on their specific needs. The company provides coverage for accidents, illnesses, and preventive care, with options to include wellness rewards. Embrace is noted for its flexibility, offering diminishing deductibles and multiple discount opportunities. With a strong focus on customer education and support, Embrace aims to enhance the pet insurance experience and increase the adoption of comprehensive pet health coverage across the United States.

Anicom Holdings, based in Japan, is a prominent pet insurance provider known for its extensive network and comprehensive policies. The company offers various coverage plans catering to different pet health needs, including accident and illness policies. Anicom’s strong market presence in Japan is bolstered by its partnerships with veterinary clinics and pet stores, making insurance accessible and convenient for pet owners. The company’s continuous efforts to improve service quality and policy options have solidified its position as a leading pet insurance provider in the Asian market.

Pet Insurance Market Key Players:

- Trupanion

- Nationwide Mutual Insurance Company

- Healthy Paws Pet Insurance LLC

- Embrace Pet Insurance Agency LLC

- Anicom Holdings

- Figo Pet Insurance LLC.

- Agria Pet Insurance Ltd.

- 24 Pet Watch

- Pets Best Insurance Services LLC

- ASPCA

- Pet Plan Insurance

- MetLife Services and Solutions LLC

- Petfirst Healthcare LLC

- Ipet Insurance Co Ltd.

- Hartville Group

- ASPCA Pet Insurance

- Animals Friends Insurance Services Limited

- Progressive Casualty Insurance Company

- Other Key Players

Pet Insurance Market Report Scope >> Market Value (2023): USD 9.3 Billion || Forecast Revenue (2033): USD 19.15 Billion || CAGR (2024-2033): 11.9% || Base Year Estimation: 2023 || Historic Period: 2019-2022 || Forecast Period: 2024-2033.

Inquire More about report: https://market.us/report/pet-insurance-market/#inquiry

About Market.US

Market.US is renowned for its comprehensive market research and analysis, providing customized and syndicated reports to a global clientele. Specializing in a variety of sectors, they offer strategic insights and detailed market forecasts, assisting businesses in making informed decisions. With a focus on innovation and accuracy, Market.US supports clients in over 126 countries, and maintains a strong repeat customer rate, underscoring their commitment to quality and client satisfaction. Their team excels in delivering exceptional research services, ensuring that no detail is overlooked in any target market.

Contact Details

Market.us (Powered By Prudour Pvt. Ltd.)

Contact No: +1 718 618 4351.

Email: [email protected]

Blog: https://medicalmarketreport.com/

View More Trending Reports

Knee Hyaluronic Acid Injections Market Will Grow Nearly USD 3.7 Bn at a rate of 5.2% by 2033

Advanced Glycation End Products Market Predicted USD 4.5 Bn by 2033, An approximate 5.7% CAGR Growth

Menkes Syndrome Market Will Reach USD 0.5 Mn by 2033 and hit around 8.5% CAGR