Market Overview:

The contactless payment market is a rapidly growing market that is being driven by the increasing adoption of contactless payment technologies, such as near-field communication (NFC) and QR codes.

The contactless payments market involves transactions where payments are made by tapping, waving, or using a near field communication (NFC) enabled device, such as a smartphone, smartwatch, or contactless card, on a compatible point-of-sale terminal. This market has experienced substantial growth driven by technological advancements, changing consumer preferences, and the need for convenient and secure payment options.

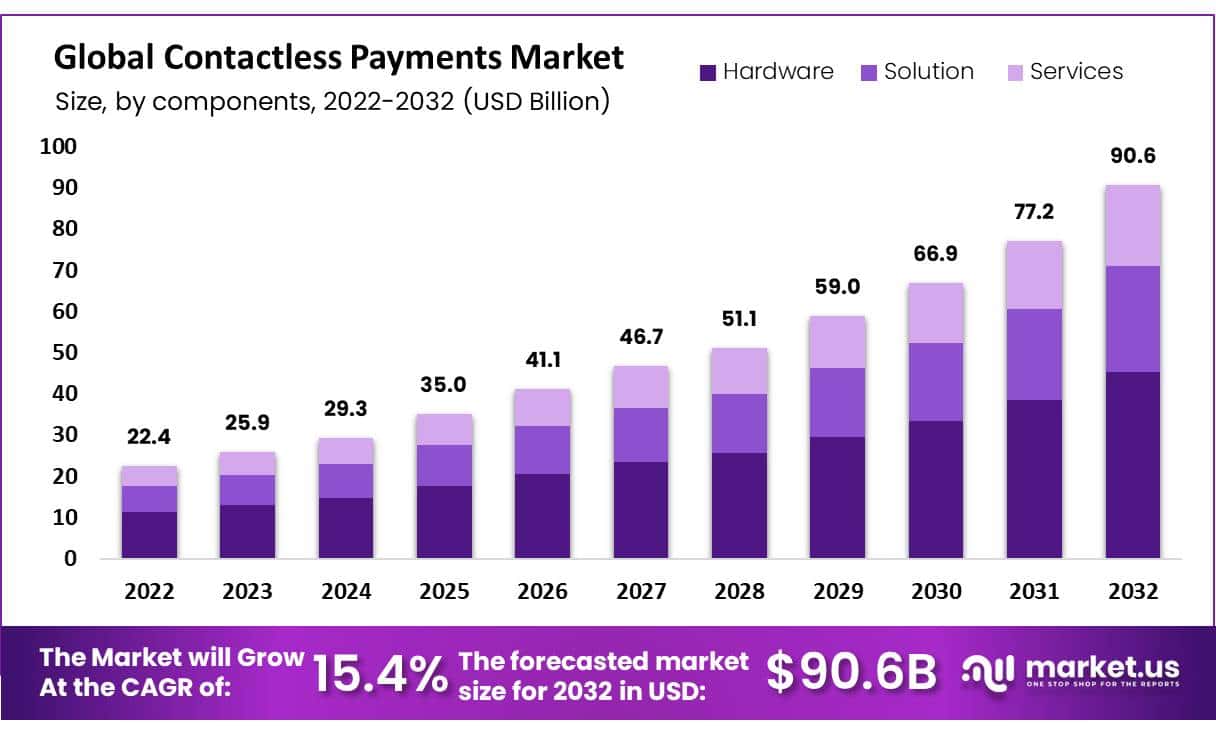

The global contactless payments market was valued at US$ 22.4 billion in 2022 and is expected to grow US$ 90.6 billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 15.4%.

Market.us has identified key trends, drivers, and challenges in the market, which will help clients improve their strategies to stay ahead of their competitors – View a sample report

Key Takeaways:

- Convenience: Contactless payments offer a quick and hassle-free way for consumers to make transactions without the need to physically insert cards or enter PINs.

- Security: With encryption and tokenization, contactless payments are designed to be secure, as the actual card information is not transmitted during the transaction.

- Mobile Wallets: Mobile wallet apps like Apple Pay, Google Pay, and Samsung Pay are popular examples of contactless payment solutions, allowing users to store multiple cards and make payments using their smartphones.

- Rise of NFC Technology: Near field communication technology enables devices to communicate wirelessly over short distances, facilitating seamless contactless transactions.

- Merchant Adoption: Businesses are increasingly adopting contactless payment technology to enhance customer experience and streamline transactions.

Market Trends:

- Biometric Authentication: Some contactless payment systems incorporate biometric authentication, such as fingerprint or facial recognition, to add an extra layer of security.

- Wearable Technology: The integration of contactless payment capabilities into wearables like smartwatches and fitness trackers is gaining traction.

- IoT Integration: The Internet of Things (IoT) is being leveraged to enable contactless payments through everyday objects, such as smart refrigerators or connected cars.

- Cross-Border Transactions: Contactless payment systems are being designed to facilitate cross-border transactions, allowing users to make payments in various currencies seamlessly.

- In-App Payments: In-app contactless payments are becoming more common, allowing users to make purchases within mobile apps without needing to enter payment details.

Rising Demands and Increasing Uses:

- Retail and E-Commerce: Contactless payments are widely used in retail stores and online shopping, making the checkout process faster and more convenient.

- Public Transportation: Many cities have adopted contactless payment systems for public transportation, allowing passengers to pay for fares using contactless cards or mobile wallets.

- Restaurants and Hospitality: Contactless payments are embraced in restaurants, cafes, and hotels, enabling customers to settle bills with ease.

- Entertainment Venues: Contactless payments are increasingly accepted at theaters, stadiums, and music venues for ticket purchases and concessions.

- Parking Solutions: Parking facilities and services are integrating contactless payment options to simplify the parking payment process.

Immediate Delivery Available | Buy This Premium Research Report@ https://market.us/purchase-report/?report_id=60952

Drivers:

- Speed and Efficiency: Contactless payments offer faster transaction times compared to traditional cash or card payments, reducing queues and wait times.

- Hygiene Concerns: The COVID-19 pandemic has accelerated the adoption of contactless payments due to concerns about the transmission of germs through cash handling.

- Technological Adoption: The proliferation of NFC-enabled devices, smartphones, and wearable gadgets has driven the adoption of contactless payment solutions.

- Consumer Preferences: Modern consumers are drawn to convenient, secure, and frictionless payment methods, favoring contactless options.

Restraints and Challenges:

- Merchant Readiness: While contactless payment adoption is growing, some businesses may face challenges in upgrading their point-of-sale systems to support the technology.

- Security Perceptions: Despite the security measures in place, some consumers may still have concerns about the safety of contactless payments.

- Device Compatibility: Not all devices, cards, or terminals are equipped for contactless payments, which can limit its widespread use.

- Privacy Concerns: Some users may worry about the collection and usage of personal data during contactless transactions.

Gaps and Opportunities:

- Global Adoption: Penetrating emerging markets and regions with low contactless payment adoption rates presents significant growth opportunities.

- Small Businesses: Offering affordable and user-friendly solutions for small businesses to adopt contactless payments could bridge a gap in the market.

- Education and Awareness: Focusing on educating consumers and businesses about the benefits and security of contactless payments could drive wider acceptance.

- Integration with Loyalty Programs: Integrating contactless payments with loyalty and reward programs can enhance customer engagement and incentivize adoption.

Roadblocks & Challenges:

- Infrastructure Development: Developing and maintaining the required infrastructure, including NFC-enabled devices and terminals, can be challenging.

- Consumer Education: Overcoming the inertia associated with adopting new payment methods and addressing misconceptions about security and convenience.

- Regulatory Compliance: Adhering to evolving regulatory frameworks for digital payments and data protection across different regions.

- Interoperability: Ensuring compatibility and interoperability among various contactless payment systems and devices.

The growth of the contactless payment market is being driven by a number of factors, including:

- The increasing popularity of mobile payments: Mobile payments are becoming increasingly popular, as they offer a convenient and secure way to pay for goods and services. Contactless payments are a key part of the mobile payments ecosystem.

- The growing demand for convenience: Consumers are increasingly demanding convenience, and contactless payments offer a quick and easy way to pay for goods and services.

- The need for contactless payments during the COVID-19 pandemic: The COVID-19 pandemic has accelerated the adoption of contactless payments, as consumers are looking for ways to reduce contact with others.

For additional information on the vendors covered – Grab an Exclusive Sample Report

Key Market Segments:

Based on Component

- Hardware

- POS

- Cards

- Others

- Solution

- Payment Terminal Solution

- Device Management Solution

- Contactless Mobile Payment Solution

- Transaction & Data Management

- Security and Fraud Management

- Services

- Consulting

- Integration & Deployment

- Support & Maintenance

Based on Application

- Retail

- Transportation

- Healthcare

- Hospitality

- Other Applications

Market Key Players

- Gemalto

- Infineon

- Ingenico

- Wirecard

- Verifone

- Giesecke+Devrient

- IDEMIA

- On Track Innovations

- Identiv

- CPI Card Group

- Bitel

- Seomatic Systems

- Valitor

- PAX Global Technology

- MYPINPAD

- Mobeewave

- Alcineo

- Castles

- SumUp

- PayCore

- Other Key Players

Explore More Reports

Exploring the EdTech: Trends, Opportunities, and Growth

EdTech Industry Poised to Surge to USD 421 Billion by 2032 with a 12.9% CAGR

Power Electronic Market Size to Surpass USD 94.21 Bn Revenue by 2032