Pet Insurance Market Upcoming Trends & Business Opportunities

The Global Pet Insurance Market latest research report is published by Market.Us. In this report, you will find an analysis of the impact of the recent market disruptions such as the Russo-Ukrainian War and Covid-19 on the market. The report provides a qualitative market analysis using different frameworks like Porter and PESTLE analysis. The Pet Insurance Market report provides detailed segmentation and market size data by category, product type, application, and geography. The report also provides a comprehensive analysis of the key issues, trends and drivers, restraints and challenges, the competitive landscape, and recent developments like mergers and acquisitions in the market.

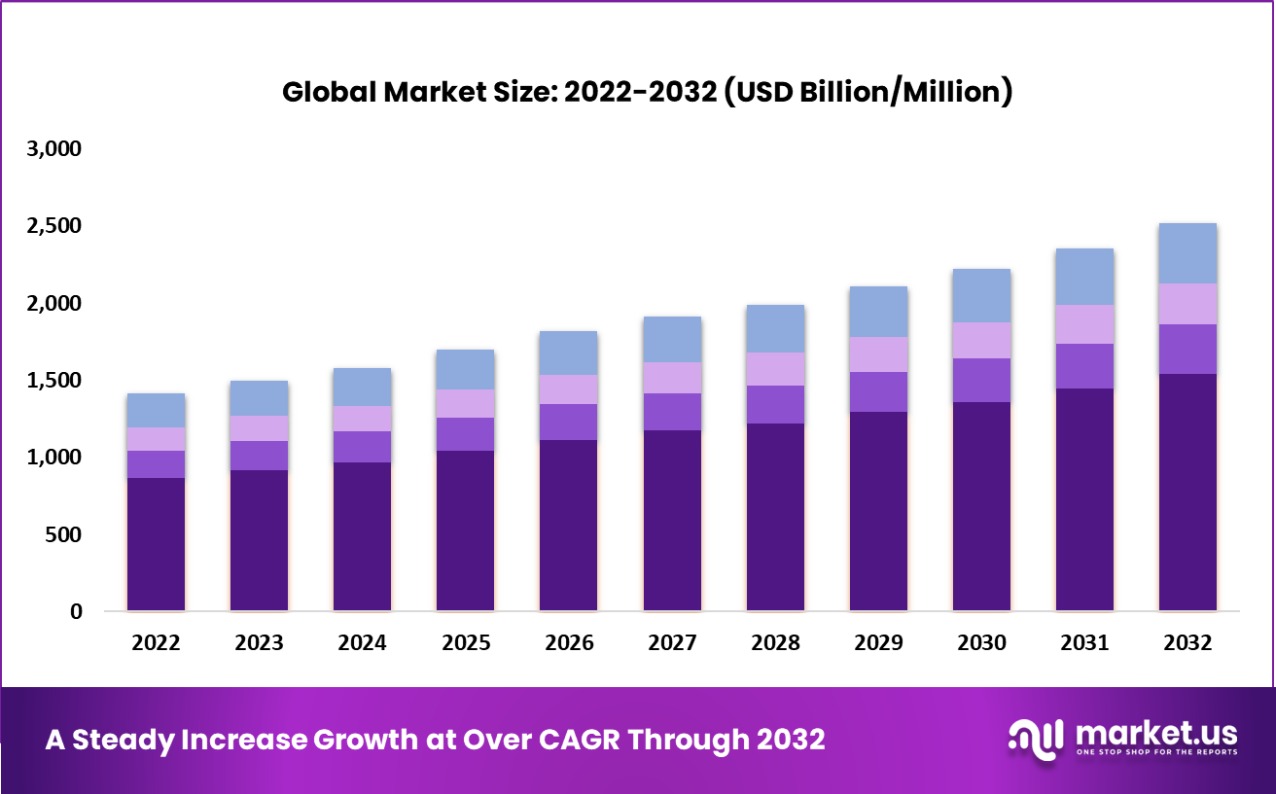

The Global Pet Insurance Market Was Valued at USD 9.3 Bn In 2022 and Is Expected To Reach USD 19.15 Bn by 2032, This Market Is Estimated To Register a CAGR Of 11.9%.

The Pet Insurance Market report provides a detailed analysis of current market trends to assess how these may impact the growth of the market. Additionally, the Pet Insurance Market encompasses an in-depth analysis of the global and regional markets along with a country-level market size breakdown to identify opportunities, challenges and better understand the market posture.

For insights on global, regional, and country-level parameters with growth opportunities from 2023 to 2032 – Download a sample report @ https://market.us/report/pet-insurance-market/request-sample/

The Pet Insurance marketplace is a dynamic and complex ecosystem where buyers and sellers interact to exchange goods, services, or goods. It serves as the backbone of economic activity, supporting trade, competition, and growth. In the Pet Insurance market, prices are determined by the forces of supply and demand and reflect the collective decisions of consumers and producers. Markets can range from small local exchanges to interconnected global networks spanning multiple industries and sectors.

The efficiency and effectiveness of the Pet Insurance market are influenced by factors such as competition, regulation, consumer preferences, technological advances, and economic conditions. In addition, markets facilitate the allocation of resources and offer companies the opportunity to innovate, grow and meet changing customer needs. Understanding Pet Insurance market dynamics is crucial for businesses, policymakers, and investors as it enables them to manage uncertainty, make informed decisions and respond to the ever-changing business landscape.

Top Pet Insurance Market Segments

Based on Coverage Type

Accident Only

Accident & Illness

Others

Based on Animal Type

Dogs

Cats

Others

Based on Sales Channel

Broker

Direct

Agency

Bancassurance

Based on Provider

Public

Private

Top Pet Insurance Market Companies

Trupanion

Nationwide Mutual Insurance Company

Healthy Paws Pet Insurance, LLC

Embrace Pet Insurance Agency, LLC

Anicom Holdings

Figo Pet Insurance LLC.

Agria Pet Insurance Ltd.

24 Pet Watch

Pets Best Insurance Services, LLC

ASPCA

Pet Plan Insurance

MetLife Services and Solutions LLC

Petfirst Healthcare LLC

Ipet Insurance Co, Ltd.

Hartville Group

ASPCA Pet Insurance

Animals Friends Insurance Services Limited

Progressive Casualty Insurance Company

Other Key Players

Pet Insurance Market Regional Analysis

-North America [United States, Canada, Mexico]

-South America [Brazil, Argentina, Columbia, Chile, Peru]

-Europe [Germany, UK, France, Italy, Russia, Spain, Netherlands, Turkey, Switzerland]

-Middle East & Africa [GCC, North Africa, South Africa]

-Asia-Pacific [China, Southeast Asia, India, Japan, Korea, Western Asia]

You Can Directly Purchase This Report From Here: https://market.us/purchase-report/?report_id=32245

Market Dynamics

Drivers

- Increasing Pet Ownership: The growing trend of pet ownership, driven by changing demographics and lifestyles, has fueled the demand for pet insurance. Pet owners consider insurance as a means to provide comprehensive healthcare coverage and financial protection for their beloved pets.

- Rising Veterinary Costs: The escalating costs of veterinary care, including diagnostics, treatments, surgeries, and medications, have underscored the value of pet insurance. Insurance coverage helps pet owners manage unexpected medical expenses and ensures that their pets receive necessary healthcare.

- Advancements in Veterinary Medicine: Advances in veterinary medicine have led to a wider range of available treatments and procedures for pets, often at a higher cost. Pet insurance addresses the financial barrier that may prevent pet owners from accessing these advanced medical options.

- Emotional Bond with Pets: Pet owners view their animals as part of the family, resulting in a desire to provide the best possible care. Pet insurance aligns with this emotional bond by offering peace of mind and access to quality healthcare without the worry of financial constraints.

Restraints

- Lack of Awareness: Many pet owners remain unaware of the benefits and availability of pet insurance. Limited awareness hampers market growth, as potential customers may not consider insurance until faced with unexpected medical expenses.

- Affordability Concerns: Some pet owners may perceive insurance premiums as an additional financial burden, especially when covering multiple pets. Balancing the cost of insurance against perceived benefits can be a barrier to adoption.

- Exclusions and Limitations: Pet insurance policies often come with exclusions, limitations, and waiting periods for pre-existing conditions. These limitations can lead to dissatisfaction if pet owners feel their pets’ specific needs are not adequately covered.

- Market Fragmentation: The pet insurance market is highly fragmented, with numerous providers offering varying levels of coverage and pricing. This complexity can make it challenging for pet owners to compare and choose the right policy.

Opportunities

- Education and Awareness Campaigns: Investment in education and awareness initiatives can help inform pet owners about the advantages of pet insurance and its role in safeguarding their pets’ health and well-being.

- Customized Coverage: Offering customizable insurance plans that allow pet owners to tailor coverage based on their pets’ specific needs and health conditions can attract a wider range of customers.

- Technological Integration: Leveraging technology to streamline claims processing, provide real-time access to policy details, and facilitate online interactions can enhance customer experience and convenience.

- Wellness and Preventive Care: Expanding insurance coverage to include wellness visits, vaccinations, and preventive care can encourage pet owners to invest in insurance for the long-term health of their pets.

What is included in the Pet Insurance Market Report Access?

• This report provides quantitative analysis of Pet Insurance market segments, recent trends, estimates, and market analysis dynamics from 2023 to 2032 to identify the market leaders & market opportunities.

• Market studies are offered with information on the main drivers, constraints, and opportunities.

• Porter’s five forces analysis underscores the potential of buyers and suppliers to empower stakeholders to make profit-oriented business decisions and to strengthen their supplier-buyer networks.

• In-depth analysis of market segmentation Pet Insurance helps to identify dominant market opportunities.

• The top countries of each region are shown based on their global market share of sales.

• The positioning of market participants facilitates benchmarking and provides a clear understanding of the current position of market participants.

• The report provides an analysis of regional and global Pet Insurance market trends, key players, market segments, application areas and market development strategies.

Key Topics Covered

1. summary

2. Pet Insurance Market Characteristics

3. Pet Insurance Market Trends and Strategies

4. Impact of COVID-19 on Pet Insurance

5. Pet Insurance Market Size and Growth

6. Pet Insurance Market segmentation

7. Pet Insurance Regional and National Market Analysis

8. Pet Insurance Market Competition and Company Profiles

9. Major Mergers and Acquisitions in the Pet Insurance Market

10. Pet Insurance Future Prospects of Market and Potential Analysis

11. Appendix

For insights on global, regional, and country-level parameters with growth opportunities from 2023 to 2032 – Download a sample report @ https://market.us/report/pet-insurance-market/request-sample/

Get in Touch with Us:

Business Development Team – Market.us

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351

Send Email: [email protected]

Our Latest Publish Reports