Introduction:

The payment processing solutions market is a dynamic and rapidly evolving industry that plays a critical role in facilitating electronic transactions between businesses, consumers, and financial institutions. Payment processing solutions encompass a wide range of technologies and services that enable the secure and efficient transfer of funds across various payment channels, including credit and debit cards, mobile wallets, online banking, and electronic funds transfers (EFT). As the world increasingly embraces digital and cashless transactions, the demand for innovative and seamless payment processing solutions continues to surge.

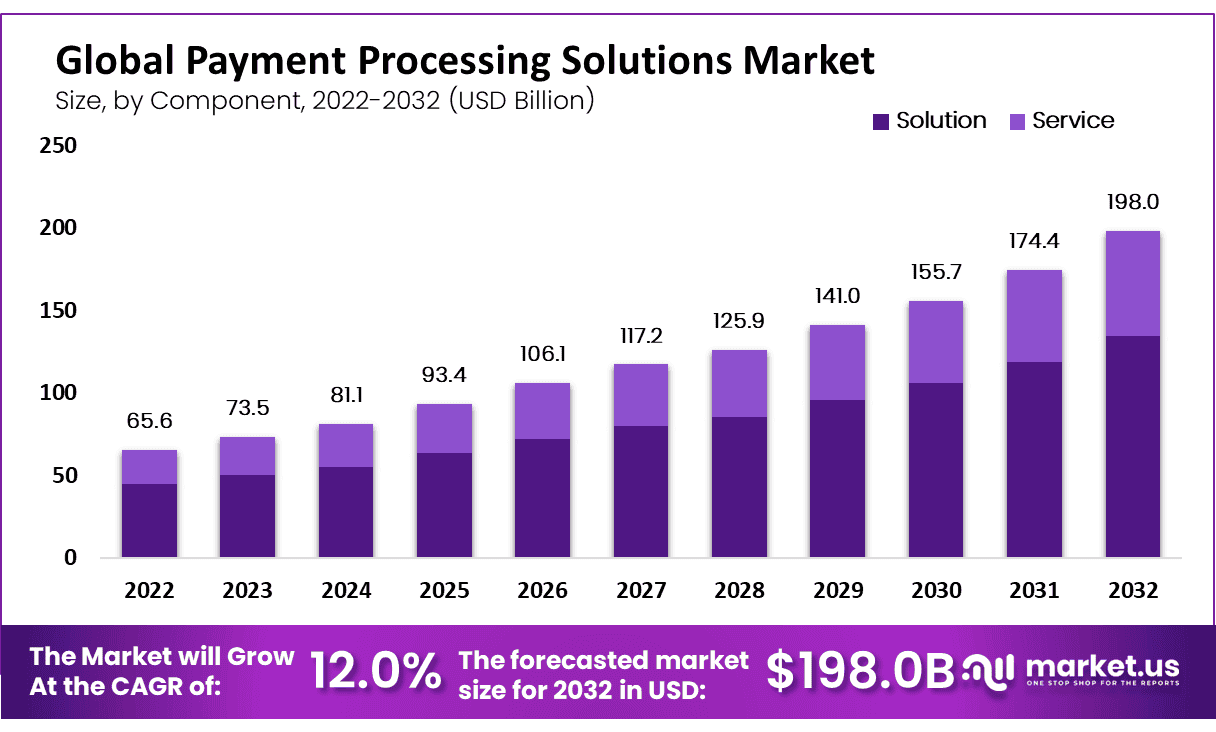

According to Market.us, The Global Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032 from USD 65.6 Billion in 2022, growing at a CAGR of 12.00%. The market is being driven by the increasing adoption of digital payments, the growing popularity of e-commerce, and the rising demand for mobile payments. Payment processing solutions play a larger role in driving financial inclusion, promoting cashless economies, and empowering businesses to thrive in the digital era. They contribute to the digitization of economies, making financial services accessible to a broader population.

For insights on global, regional, and country-level parameters with growth opportunities from 2023 to 2033 | Download a sample report

Key Takeaway:

- The payment processing solutions market is experiencing significant growth due to the rising adoption of digital payment methods and the proliferation of e-commerce.

- By component, the solution segment generated the highest revenue in the global payment processing solutions market share in 2022.

- By deployment mode, the credit card segment dominates the market with a share of 37%.

- In 2022, North-America Region dominated the market with the highest revenue share of 38.8%.

- Europe held the second-largest revenue share in 2022.

- Mobile payment solutions and contactless payment technologies are among the key drivers shaping the future of the payment processing industry.

Rising Demands:

The demand for payment processing solutions is witnessing rapid growth, driven by several factors. The global shift towards digitalization and the rise of e-commerce have led to an increased preference for cashless transactions. Consumers now expect convenient, secure, and fast payment options, whether they are making online purchases, paying bills, or shopping in brick-and-mortar stores. Moreover, the COVID-19 pandemic accelerated the adoption of contactless payments as people sought safer and hygienic payment methods.

Unlock Exclusive Market Segments Insights: Buy Now to Discover Vital Trends, Drivers and Challenges in this Industry@ https://market.us/purchase-report/?report_id=99255

Increasing Uses:

Payment processing solutions are versatile and find applications in various sectors, including:

- E-commerce: Payment gateways enable secure online transactions, allowing consumers to shop and pay for goods and services online.

- Point of Sale (POS): Payment terminals at retail stores and restaurants facilitate quick and seamless card payments.

- Mobile Payments: Mobile payment apps and wallets enable users to make transactions using their smartphones, simplifying peer-to-peer transfers and in-store payments.

- Online Banking: Electronic funds transfers and online banking platforms allow users to transfer funds and pay bills conveniently.

- Contactless Payments: Near Field Communication (NFC) technology enables contactless payments using smartphones and contactless cards, reducing the need for physical contact during transactions.

Rising Popularity:

The rising popularity of payment processing solutions can be attributed to the growing digitization of financial services and the convenience they offer. Consumers appreciate the ease of making payments anytime, anywhere, without the need for cash or physical cards. Additionally, businesses recognize the value of secure and efficient payment systems that enhance customer experience and drive sales.

Largest and Fastest-Growing Market:

The payment processing solutions market is global, with North America and Europe currently leading in terms of market size and maturity. North America, especially the United States, is a mature market with high adoption of digital payments and well-established payment infrastructure. However, the Asia-Pacific region is witnessing the fastest growth, driven by the increasing adoption of mobile payments and the expansion of e-commerce in countries like China and India.

Top 5 Trends Propelling Sales:

- Mobile Payment Revolution: The proliferation of smartphones and mobile payment apps is revolutionizing the way consumers transact, driving the demand for secure and user-friendly mobile payment solutions.

- Contactless Payment Adoption: Contactless payment methods, including NFC-enabled cards and mobile wallets, are gaining popularity due to their convenience and hygienic nature.

- Biometric Authentication: Biometric authentication methods, such as fingerprint and facial recognition, are being integrated into payment processing solutions for enhanced security and seamless user experience.

- Blockchain and Cryptocurrency Integration: Some payment processors are exploring the integration of blockchain technology and cryptocurrencies to enable faster, borderless, and secure cross-border transactions.

- Subscription and Recurring Payments: The rise of subscription-based business models is driving the demand for payment solutions that support recurring payments and subscription billing.

For additional information on the vendors covered – Grab an Exclusive Sample Report

Market Drivers:

- E-commerce Growth: The rapid expansion of e-commerce drives the demand for secure and efficient payment processing solutions.

- Digital Transformation: The global shift towards digital payments and the adoption of mobile devices as payment tools are major drivers of the payment processing market.

- Contactless Payments Adoption: Contactless payments gain traction due to their convenience and safety, particularly during the pandemic.

Restraints:

- Security Concerns: The increasing volume of digital transactions raises concerns about data breaches and cyber threats, necessitating robust security measures.

- Regulatory Compliance: Payment processing solutions must comply with various financial regulations, which can be complex and time-consuming.

- Infrastructure Challenges: In certain regions, the lack of robust payment infrastructure and access to digital devices can hinder the adoption of payment processing solutions.

Opportunities and Challenges: Opportunities:

- Cross-Border Payments: Payment processors have the opportunity to simplify and expedite cross-border payments using innovative technologies.

- Financial Inclusion: By offering accessible and user-friendly payment solutions, companies can contribute to financial inclusion in underserved areas.

- Embedded Finance: Integrating payment processing solutions into non-financial products and services opens new opportunities for businesses to enhance customer experience.

Challenges:

- Fraud Prevention: Preventing payment fraud and ensuring the security of digital transactions remain critical challenges for payment processors.

- Competitive Landscape: The payment processing market is highly competitive, requiring companies to innovate and differentiate their offerings to stay ahead.

- Consumer Trust: Building and maintaining consumer trust in digital payment systems is crucial for widespread adoption.

Market Segments:

Based on Component

- Solution

- Service

Based on the Deployment Mode

- Credit card

- Debit card

- E-wallet

- Automated Clearing House (ACH)

- Others

Based on Industry Vertical

- BFSI

- Government & Utilities

- It & Telecom

- Healthcare

- Retail & E-commerce

- Media & Entertainment

- Travel & Hospitality

- Others

Market Key Players:

- Adyen

- Alipay

- Amazon Payments, Inc.

- Authorize.Net

- PayPal Holdings Inc.

- PayU

- SecurePay

- Stripe, Inc.

- Apple Inc. (Apple Pay)

- Alphabet (Google Pay)

- Other Key Players

Explore More Reports

Aircraft Lighting Market Challenges and Opportunity Analysis till 2033

Military Augmented Reality Headgear Market Innovations and Future Outlook 2023 to 2033

Aviation Insurance Market Real Time Analysis and Forecast up to 2033

Commercial Aircraft Electronic Flight Bag Systems Market Developments And Future Scope To 2033

Commercial Aviation Crew Management Systems Market Strategies, High Growth Rate By 2033

Airport Kiosk Market Insights Focusing on Primary Trends until 2033

Airport Sleeping Pods Market Demand and Developments by 2033

Airport Baggage Screening Systems Market 2023: Huge B2B Opportunities 2033

Airport Management Market Expected a Major Surge in Revenue by 2033