Report Highlights

The Credit Cards market is Likely to provide excellent returns among top industries worldwide right now that are on track to become the most profitable.

The market report Credit Cards provides a comprehensive overview of key elements including drivers, limitations, historical trends, current trends, technical development, and future growth. This report covers both system-dynamic approaches and technologies that will give business players an advantage over their competitors. This survey report covers the major market insights and industry approach toward COVID-19 in the upcoming years.

Smart Objectives:

The relevant objective of this research aims to assist the user in understanding the market. It includes its definition, key-supply demand analysis, product specifications, production value, market segmentation (Type, Application, and Geographical), market potential, influential trends, and current market challenges. An extensive analysis of the projected market value for global Credit Cards on the basic value and volume.

Are you a start-up willing to make it BIG in the business? Grab an exclusive FREE PDF Brochure of this report@ https://market.us/report/credit-cards-market/request-sample/

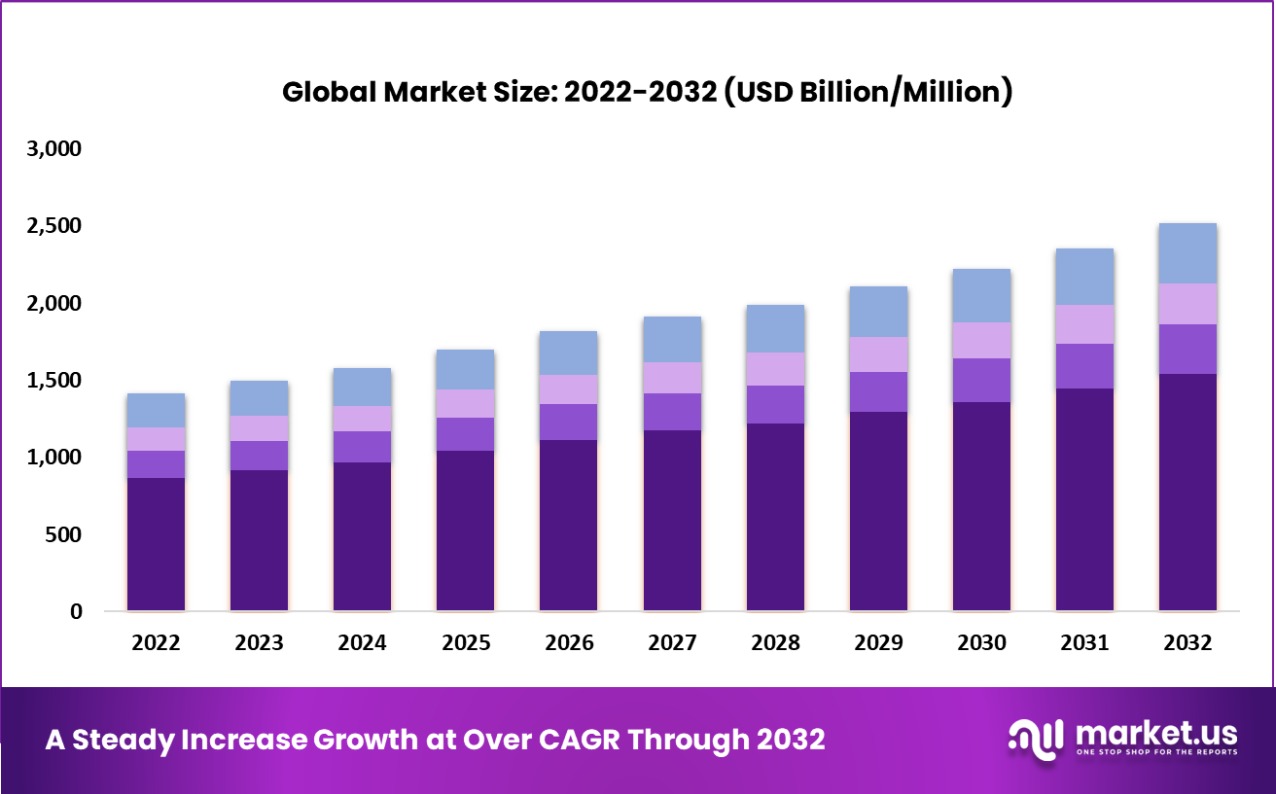

Figure 1: Global Market Size Image (2022-2032)

The report includes several factors that contributed to the recent growth of the market. This report gives a 360-degree view of the market. The report also provides extensive statistics about current trends, technological advancements, and tools. The data is organized into chapters to make it easier to read and understand. Each chapter can be further divided into segments that contain well-structured information.

The top world’s Biggest companies [Updates] operating in the global Credit Cards market profiled in the report are [ American Express, Banco Ita?, Bank of America Merrill Lynch, Bank of Brazil, Bank of East Asia, Chase Commercial Banking, Diner?s Club, Hang Seng Bank, Hyundai, JP Morgan, MasterCard, SimplyCash, Sumitomo Mitsui Banking Corporation, Visa, WEX Inc ].

Market to Expand Rapidly

– Geographically speaking, the global Credit Cards market can roughly be divided into five regions: North America (NA), Europe (EU), Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SA).

– North American country-level analyses include the U.S., Canada, and the Rest of North America. Analysis and forecast of the Credit Cards market in Europe include markets across the U.K., Germany, France, and the Rest of Europe. Similarly, Asia Pacific includes India, China, Japan, and the Rest of Asia Pacific. The Middle East & Africa includes the Credit Cards market analysis and forecast of GCC countries, South Africa, and the Rest of the Middle East & Africa. The South America Credit Cards market is segmented into Brazil and the Rest of South America.

– Due to its large player base, North America held the largest share of the Credit Cards market globally in 2023. The Credit Cards market in the Asia Pacific will expand faster than the rest of the world in the next few years due to a growing number of players.

Latest Research Studies, Through Flexible and Convenient Payment Methods | Purchasing this Report: https://market.us/purchase-report/?report_id=67722

Key Benefits for Industry Participants and Stakeholders

– Market drivers, restraints, and opportunities covered in the study

– Neutral perspective on the market performance

– Recent industry trends and developments

– Competitive landscape & strategies of key players

– Potential & niche segments and regions exhibiting promising growth covered

– Historical, current, and projected market size, in terms of value

– In-depth analysis of the Credit Cards Sales Market

Key Players Operating in This Market

The growing popularity of Credit Cards is predicted to cause a surge in demand for key players. Manufacturers are offering customized gloves and new quality models. Vendors are working hard to improve the efficiency of their market distribution channels, especially online. Credit Cards are active products and their improvement is supported by factors like technology and innovation.

To gain access to more vendor profiles with their key offerings available with Market.us, Click Here: https://market.us/report/credit-cards-market/#inquiry

Type

- Small Business Card

- Corporate Card

- Personal Credit Cards

Application

- Banking, Financial Services, and Insurance (BFSI)

- Personal Consumption

- Business

Key Market Players included in the report:

- American Express

- Banco Ita?

- Bank of America Merrill Lynch

- Bank of Brazil

- Bank of East Asia

- Chase Commercial Banking

- Diner?s Club

- Hang Seng Bank

- Hyundai

- JP Morgan

- MasterCard

- SimplyCash

- Sumitomo Mitsui Banking Corporation

- Visa

- WEX Inc.

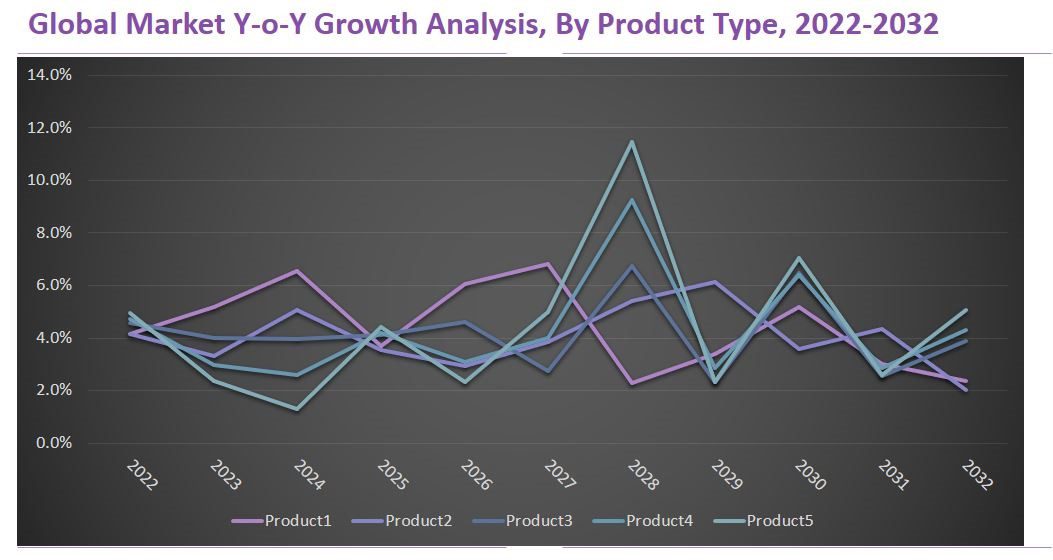

Figure 2 Indicated: The World Market Has Been Segmented As Follows

The Market Factors Described In This Report Are

Significant Strategic Developments in the Market:

The Credit Cards Market research includes the key strategic activities such as R&D plans, M&A completed deals, product releases, collaborations, partnerships & (JV) Joint ventures, and regional growth of key global and regional competitors.

Key Market Features of Market:

The report highlights Credit Cards Market features, including revenue, weighted average regional price, capacity utilization rate, production rate, gross margins, consumption, import & export, supply & demand, cost bench-marking, market share, CAGR, and gross margin.

Analytical Market Highlights & Approach:

The Credit Cards Market report offers rigorously analyzed and assessed data on the key industry players and their market share through a variety of analytical methods. Analytical resources such as Porter’s five Strength analysis, Feasibility Review, SWOT analysis, and ROI analysis have been practiced in reviewing the growth of the key players operating in the Credit Cards market.

Some of the Crucial Questions Answered In This Report

#1: What is the market size for Credit Cards ?

#2: What are the best features of a Credit Cards ?

#3: What are the benefits of buying a Credit Cards Market?

#4: What are the different types of Credit Cards ?

#5: Which will be the best applications?

#6: Which are the major global Credit Cards companies?

#7: What are the market driving factors behind the Credit Cards market?

#8: What are the market trends and forecasts for the global Credit Cards market?

Contact our Market Specialist Team

Global Business Development Teams – Market.us

Market.us (Powered By Prudour Pvt. Ltd.)

Send Email: [email protected]

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351

Website: https://market.us