Generative AI in fintech market refers to the application of generative artificial intelligence (AI) techniques in the financial technology sector. Generative AI involves the use of machine learning algorithms to generate new data, content, or models that mimic human-like creativity and decision-making. In the fintech industry, generative AI is utilized for various purposes such as fraud detection, risk assessment, customer service, trading strategies, and personalized financial recommendations.

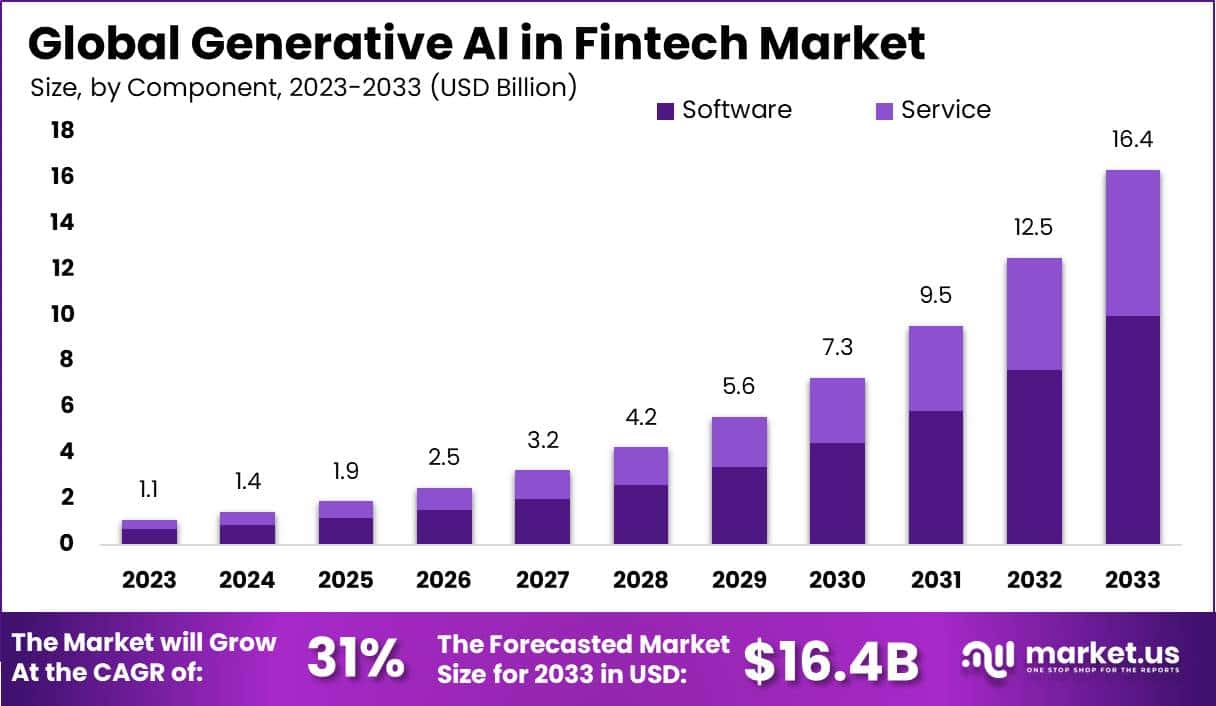

Generative AI in Fintech Market will exceed USD 6,256 million by 2032, rising from USD 865 million in 2022. Furthermore, it is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 22.5% between 2023 and 2032.

Charts and data tables about market and segment sizes for a historic period of five (2017-2022) years have been covered in this report | View our PDF Sample Report @ https://market.us/report/generative-ai-in-fintech-market/request-sample/

Key Takeaways:

- Fraud Detection and Security: Generative AI algorithms can analyze large volumes of financial data to identify patterns and anomalies that may indicate fraudulent activities. By continuously learning from past instances, generative AI models improve fraud detection capabilities and enhance the security of financial transactions.

- Risk Assessment and Management: Financial institutions use generative AI to assess and manage risks associated with investments, loans, and credit scoring. AI models analyze historical data, market trends, and economic indicators to provide real-time risk assessments, enabling more informed decision-making.

- Customer Service and Personalization: Generative AI enables personalized customer experiences in fintech. Natural language processing and machine learning algorithms allow virtual assistants and chatbots to understand customer inquiries, provide accurate responses, and offer tailored financial recommendations or products based on individual preferences.

- Trading and Investment Strategies: Generative AI is employed in algorithmic trading and investment strategies. AI models analyze vast amounts of financial data, market trends, and historical patterns to identify trading opportunities, optimize investment portfolios, and execute trades with speed and accuracy.

- Regulatory Compliance: Generative AI assists financial institutions in complying with regulatory requirements. AI algorithms can analyze financial data to ensure adherence to regulations, detect suspicious transactions, and automate reporting processes, reducing compliance risks and operational costs.

Predictions about the Future:

- Enhanced Risk Prediction: Generative AI models will continue to advance in their ability to predict and manage financial risks. By incorporating more sophisticated algorithms and accessing a wider range of data sources, AI will provide more accurate risk assessments, aiding in decision-making and risk management.

- Improved Customer Experience: Generative AI will further enhance the customer experience in fintech by delivering personalized and context-aware financial services. AI-powered virtual assistants will understand and respond to customer needs more effectively, providing tailored recommendations, financial advice, and support.

- Ethical and Explainable AI: As generative AI becomes more prevalent in fintech, there will be an increasing focus on ethical considerations and explainability. Financial institutions will prioritize transparency and accountability in AI algorithms to ensure fair and unbiased decision-making, comply with regulations, and maintain customer trust.

- Collaboration between AI and Human Experts: The future of generative AI in fintech will involve greater collaboration between AI systems and human experts. AI algorithms will augment human decision-making, providing insights and recommendations, while human experts will provide oversight, interpret results, and make final decisions.

- Expansion of Use Cases: The use of generative AI in fintech will expand to various areas, including credit underwriting, insurance claims processing, regulatory reporting, portfolio management, and financial planning. The technology will continue to evolve, offering new possibilities and opportunities for innovation in the financial sector.

Generative AI in Fintech Market Segments Evaluated in the Report:

Based on Component

- Service

- Software

Based on Deployment

- On-Premises

- Cloud

Based on Application

- Credit Scoring

- Compliance & Fraud Detection

- Personal Assistants

- Digital assistants

- Financial assistants

- Asset Management

- Predictive Analysis

- Insurance

- Debt Collection

- Business Analytics & Reporting

- Customer Behavioral Analytics

Based on End-Use Industry

- Retail Banking

- Investment Banking

- Stock Trading Firms

- Hedge Funds

- Other Industries

Competitive Spectrum – Top Companies Leveraging Generative AI in Fintech Market

- Open AI

- Microsoft Corporation

- Google LLC

- Genie AI Ltd.

- IBM Corporation

- MOSTLY AI Inc.

- Veesual AI

- Adobe Inc.

- Synthesis AI

- AI

- Other Key Players

**Note: If any Company(ies) of your interest has/have not been disclosed in the above list then please let us know the same so that we will check the data available in our database and provide you the confirmation or inclusion in the final deliverables.**

More Related Reports

Generative AI in Business Market Poised for Remarkable Growth, to Surpass US$ 20.9 Bn by 2032

Generative AI in Music Market to Reach Valuation of USD 2.6 Bn at CAGR of 28.6% by 2032

Generative AI in Marketing Market Predicted to Garner US$ 22.1 Bn by 2032, At CAGR 28.6%

Not interested in buying the full report? No problem.

You can buy individual sections instead. Would you like to see the price list for each section? Get the details here: https://market.us/report/generative-ai-in-fintech-market/#inquiry

With competitive analysis research, you can find out things like:

1. Who your competitors are?

2. What they’ve done in the past?

3. What’s working well for them?

4. How they’re positioned in the market?

5. How do they market themselves?

6. What they’re doing that you’re not?

7. Their weaknesses

Key regions divided during this report:

– The Middle East and Africa Generative AI in Fintech Market (Saudi Arabia, United Arab Emirates, Egypt, Nigeria, South Africa)

– North America Generative AI in Fintech Market (United States, Canada, Mexico)

– Asia Pacific Generative AI in Fintech Market (China, Japan, Korea, India, Southeast Asia)

– South America Generative AI in Fintech Market (Brazil, Argentina, Colombia)

– Europe Generative AI in Fintech Market (Germany, UK, France, Russia, Italy)

Access the full study findings here: https://market.us/report/generative-ai-in-fintech-market/

Why buy?

– Data-Driven Decision Making and Business Opportunities

– Identify growth strategies across markets

– Analyze your competitor’s market

– Know the financial performance of competitors with better insight

– Benchmark performance in comparison to key competitors

– Develop regional and country strategies

Generative AI in Fintech market research report will be sympathetic for:

1. New Investors

2. Propose investors and private equity companies

3. Cautious business organizers and analysts

4. Intelligent network security Suppliers, Manufacturers and Distributors

5. Government and research organizations

6. Speculation / Business Research League

7. End-use industries And much more

FAQs or How Report will help you?

Q1. How big is the Generative AI in Fintech market?

Q2. What is the projected market size & growth rate of the Generative AI in Fintech Market?

Q3. What are the key driving factors for the growth of the Generative AI in Fintech Market?

Q4. What are the key trends in the Generative AI in Fintech market report?

Q5. What is the total market value of Generative AI in Fintech market report?

Q6. What segments are covered in the Generative AI in Fintech Market Report?

Q7. Who are the key players in Generative AI in Fintech market?

Q8. Which region has the highest growth in Generative AI in Fintech Market?

Report Scope

| Report Attribute | Details |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2033 |

TOC Highlights:

Chapter 1. Introduction

The Generative AI in Fintech research work report covers a brief introduction to the global market. this segment provides opinions of key participants, an audit of Generative AI in Fintech industry, an outlook across key regions, financial services and various challenges faced by Generative AI in Fintech Market. This section depends on the scope of the study and report guidance.

Chapter 2. Outstanding Report Scope

This is the second most important chapter, which covers market segmentation along with a definition of Generative AI in Fintech. It defines the entire scope of the Generative AI in Fintech report and the various facets it is describing.

Chapter 3. Market Dynamics and Key Indicators

This chapter includes key dynamics focusing on drivers[ Includes Globally Growing Generative AI in Fintech Prevalence and Increasing Investments in Generative AI in Fintech, Key Market Restraints [High Cost of Generative AI in Fintech], opportunities [Emerging Markets in Developing Countries] and also presented in detail the emerging trends [Consistent Launch of New Screening Products] growth challenges, and influence factors shared in this latest report.

Chapter 4. Type Segments

This Generative AI in Fintech market report shows the market growth for various types of products marketed by the most comprehensive companies.

Chapter 5. Application Segments

The examiners who wrote the report have fully estimated the market potential of key applications and recognized future opportunities.

Chapter 6. Geographic Analysis

Each regional market is carefully scrutinized to understand its current and future growth, development, and demand scenarios for this market.

6.1 North America: insight study

6.2 Europe: serves complete insight study

6.3 Asia-Pacific

6.4 Rest of the World

Chapter 7. Top Manufacturing Profiles

The major players in the Generative AI in Fintech market are detailed in the report based on their market size, market service, products, applications, regional growth, and other factors.

Chapter 8. Pricing Analysis

This chapter provides price point analysis by region and other forecasts.

Chapter 09. North America Generative AI in Fintech Market Analysis

This chapter includes an assessment of Generative AI in Fintech product sales across major countries of the United States and Canada along with a detailed segmental outlook across these countries for the forecasted period 2022-2031.

Chapter 10. Latin America Generative AI in Fintech Market Analysis

Major countries of Brazil, Chile, Peru, Argentina, and Mexico are assessed apropos to the adoption of Generative AI in Fintech.

Chapter 11. Europe Generative AI in Fintech Market Analysis

Market Analysis of Generative AI in Fintech report includes insights on supply-demand and sales revenue of Generative AI in Fintech across Germany, France, United Kingdom, Spain, BENELUX, Nordic and Italy.

Chapter 12. Asia Pacific Excluding Japan (APEJ) Generative AI in Fintech Market Analysis

Countries of Greater China, ASEAN, India, and Australia & New Zealand are assessed and sales assessment of Generative AI in Fintech in these countries is covered.

Chapter 13. The Middle East and Africa (MEA) Generative AI in Fintech Market Analysis

This chapter focuses on Generative AI in Fintech market scenario across GCC countries, Israel, South Africa, and Turkey.

Chapter 14. Research Methodology

The research methodology chapter includes the following main facts,

14.1 Coverage

14.2 Secondary Research

14.3 Primary Research

Chapter 15. Conclusion

Communication Contact:

Global Business Development Team: Market.us

Market.us (Powered By Prudour Pvt. Ltd.)

Send Email: [email protected]

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351

Website:https://market.us/